In 1992, three computer scientists, Timothy May, John Gilmore and Eric Hughes, launched a mailing list which would become known as the Cypherpunks. The term is a portmanteau word coined from cyberpunk and ciphers.

The list, devoted to discussions on mathematics, cryptography, philosophy among other ‘nerdy’ topics, had as a primary goal the advocacy of Internet privacy and individual liberties in the face of giant corporations and government oversight.

Over time, it grew to incorporate more members of the larger tech community. Prominent leaders in today’s tech world and cryptography experts were at one point or the other a part of this esteemed group.

To name just a few, Marc Andreessen — the co-founder of Mosaic which was the first widely used web browser as well as the now defunct Netscape, Julian Assange — the famous journalist and founder of Wikileaks, Nick Szabo — the inventor of smart contracts which are the building blocks of code on the Ethereum network, and Hal Finney — one of the early developers of Bitcoin, now deceased. Make a note of these names, you’ll be hearing more about some of them as you proceed.

On January 17, 1993, just three days before Bill Clinton was sworn in as the 42nd President of the United States, Finney sent an email to the Cypherpunk mailing list. At the time, the mail was sent in jest. This joke would turn out to be very prescient as it accurately foretold what we now come to know as NFTs.

What are NFTs?

It would take another two decades for Finney’s prediction to manifest and it did that in some style. Although 2014 was the first time NFTs were heard of in public discourse, 2021 was when NFTs really took off. That year alone according to data from DappRadar, NFTs generated over $23 billion in trading volume—up from $94.9 million the year before.

Now that I fully have your attention let’s define what an NFT is. NFT, short for non-fungible token is in simple terms a digital asset that is representative of real-world items like art, music, videos, a merch in an online game, physical collectibles, or even a tweet!

Let’s break down what the words themselves mean. The word ‘non-fungible’ is the opposite of fungible which means mutually interchangeable. The naira for example, is fungible because you can swap it for another naira. Same with bitcoin.

A token is anything that serves as a visible or tangible representation of something which in this case as explained earlier, is a real-world item. In Finney’s email, he referred to these digital tokens as “cryptographic trading cards”.

Because a cryptographic card is embedded with unique code, such a card would be non-fungible. If you trade it for a different card, you would be getting something different from what you originally had.

Now if your curiosity is piqued at this point you’re probably wondering: what if I just take a photo of an NFT, what’s to stop me from claiming ownership and selling it?

More of that in a bit.

Smart contracts

Remember Nick Szabo from our story? The guy who invented smart contracts? Well, it’s thanks to him that NFTs possess the uniqueness they have. The code behind every NFT is known as a smart contract. So what’s that?

A smart contract is a self-executing program that includes terms of agreement between a buyer and seller which runs when the predetermined conditions are met. To the earlier question of whether taking a photo of an NFT duplicates it and confers ownership rights, the answer is no. If I take a photo of a Picasso, does that automatically mean I own one?

The reason is that while you may have a ‘copy’ of the NFT’s image, the underlying uniqueness isn’t in the jpeg per se, but in the smart contract that powers it which provides its unique ID and metadata.

This critical feature is also what makes them valuable as it guarantees that your NFT is original. To provide just one example of the role smart contracts play in authenticating digital assets, the YouTube star Logan Paul in January was conned of $3.5 million when he purchased an unopened set of first edition Pokémon cards that turned out to be G.I. Joe cards. With NFTs, such scams are improbable.

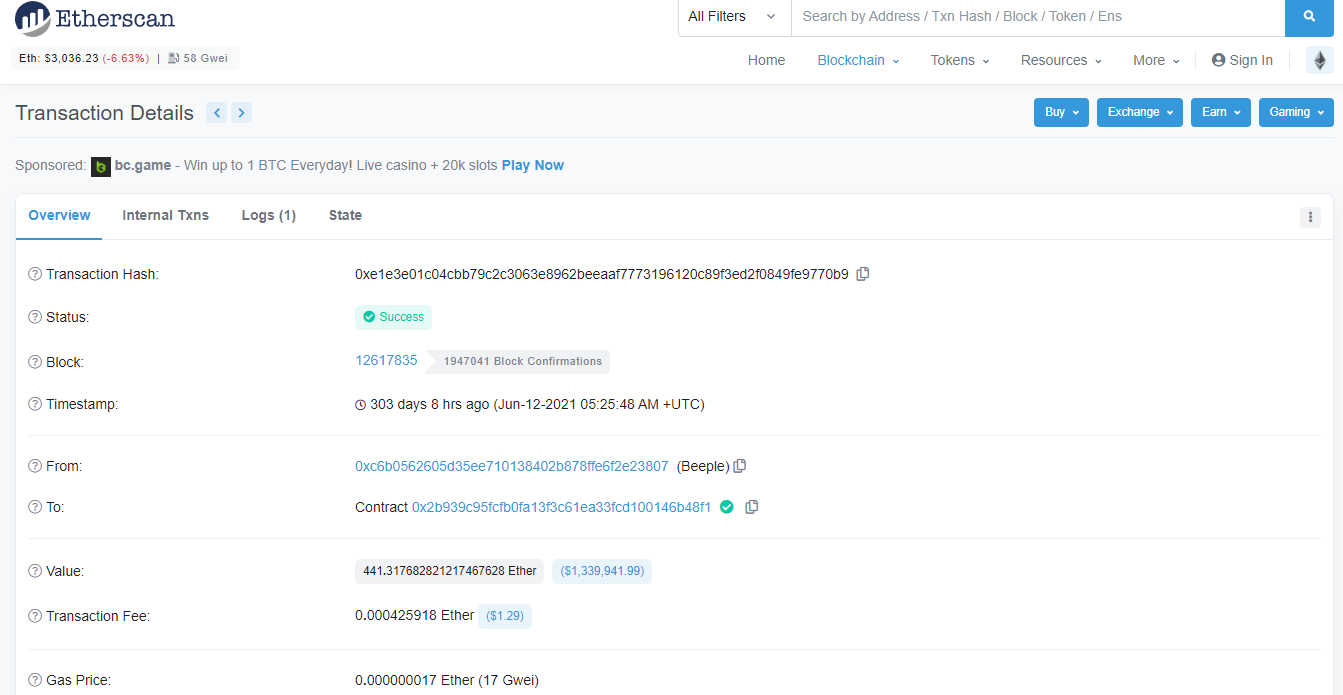

When you buy an NFT using Ether, its record is publicly available on a ledger, depending on the platform where it is traded. Most transactions can be viewed on Etherscan, a block explorer and analytics platform for Ethereum, which provides all details concerning a trade. Here’s what that looks like:

For a comprehensive guide on how to make your own NFTs, check out this resource from Binance.

The appeal behind NFTs

The idea behind NFTs is not exactly novel. After all, when Finney was describing his cryptographic cards he was likely referencing baseball cards which have long been a favourite collectors’ item. But what explains the rave behind NFTs?

Several theories exist. According to this stellar piece by NextAdvisor, a combination of factors including the Ethereum and Bitcoin bull run of 2021 coupled with the unpredictable adoption curve of new technologies contributed to its mainstream acceptance.

Another plausible factor includes the lockdown created by the pandemic which gave rise to more people looking to explore avenues to make money. As word of mouth got out through celebrities like Paris Hilton, William Shatner — who sold 90,000 virtual trading cards as NFTs last year for $1 each, and musician Grimes — who sold $6 million worth of her digital art, more people decided to hop on the NFT money train.

The exclusivity that comes with NFTs is also an important point. The Bored Ape Yacht Club (BAYC) for instance, is a collection of 10000 unique Bored Ape NFTs — unique digital collectibles found on the Ethereum blockchain and the largest NFT avatar by market capitalization. At its peak, the floor price of owning one such NFT was $350,000 — with one selling as high as $2.8 million in January.

The cachet that comes with owning a BAYC NFT provides an appeal of its own, with collectors happy to flaunt their art on social media. Owning one of those can grant you a pass to the most exclusive events where one gets to meet celebrities and build social capital via networking.

The ugly side of NFTs

“The peril is you have these $3 million monkeys and it becomes a different kind of gambling”. — Vitalik Buterin

Last month, Ethereum’s founder Vitalik Buterin made the cover of TIME. In an interview which has had ripple effects on the Web 3.0 community, Buterin expressed fears over the public perception of crypto including of course the quote above which some regard as a perceived slight at BAYC.

Beyond the hype, skeptics offer an uneasy argument against NFTs which is that they fall under a class of assets that are highly speculative. The FOMO* combined with the urgency to auction an NFT before the window of opportunity expires, leads to a bubble where the price and volume of trade in NFTs experience an inflationary trajectory. (*FOMO—Fear of missing out)

This argument underpins the Greater Fool Theory which describes the idea that during a market bubble, one can make money by buying overvalued assets and selling them for a profit later, because there is “a greater fool” willing to pay a higher price.

There are indications that the hype is beginning to cool off with the Financial Times reporting that the average selling price of an NFT dropped more than 48 per cent since November to around $2,500 in February. Daily trading volumes on OpenSea also plummeted 80 per cent to roughly $50 million in March, just a month after they reached a record peak of $248 million in February.

Beside these, there are other issues which concern a variety of scams that are prevalent both in the digital collectibles market of NFTs and the larger crypto space as well. The most salient ones are rug pulls, a term that describes what happens when a startup or influencer promotes a crypto token, NFT or DAO project, solicits public investment, then vanishes with the cash or stops updating the project; Wash trading, a form of round-tripping where one tries to inflate the value of an asset by buying and selling it back to their self; and pump and dumps where one uses misleading information to raise the price of an asset before selling at a profit.

It’s germane to note that while these concerns exist, they are not peculiar to NFTs and are in fact unhealthy practices borrowed from the world of traditional finance.

It’s not all doom and gloom however, as you’re about to discover.

The beautiful side of NFTs

NFTs have in very recent times been used to great effect. You remember Julian Assange from earlier? For those unaware, Assange is an Australian journalist who has been imprisoned in London since 2019 over espionage charges. Because the charges levelled against him are grave with looming threats of extradition to the US along with bleak prospects of facing up to 175 years in prison, he has sought for all available resources to finance his defense.

In February the anonymous NFT artist Pak, in consortium with the AssangeDAO* which had over 10,000 supporters, successfully bid 16,593 ETH (approx. $52 million at the time) for Clock, a single-edition NFT that counts the number of days since Assange was arrested in April 2019. (*To learn more about DAOs, short for decentralized autonomous organization, check out this detailed explainer by Tejumade Adeyinka.)

On a much bigger scale, the Ukrainian government in March announced that it is selling a timeline of the Russian invasion as NFTs with proceeds going to its army as well as civilians. So far, the government has raised over $60 million dollars.

This month, the famous coffin meme which has brought laughter to many people was sold as an NFT for 327 ETH ($ 1,045,409).

Much closer to home in a story that warmed a lot of hearts, an 80-year-old drummer Ayangbenle, fondly referred to as Baba Onilu, received a pleasant surprise when an NFT painting of him was sold on the NFT marketplace OpenSea, by youth corp member Adisa Olashile for 0.6 ETH ($2,098.32). Half of the proceeds from the sale amounting to ₦500,000 was disbursed to the man. The palpable joy on his face tells its own story.

Conclusion

While not everyone is sold on NFTs, it is worthwhile to acknowledge that it is finding utility beyond its classification as a speculative asset. Just this month, the UK’s Chancellor Rishi Sunak, ordered the Royal Mint to create the UK government’s first ever NFT which it notes is to “ensure the UK financial services sector remains at the cutting edge of technology, attracting investment and jobs and widening consumer choice.”

Similarly, applications of NFTs can be found in popular play-to-earn games like Axie Infinity where Axie characters are bred and bought as NFTs, creating a booming ecosystem for avid gamers.

The use for NFTs has also evolved towards the entertainment industry. Last year, American rock band Kings of Leon generated $2million from NFT sales of their album. More music artists are following suit.

As Peter Yang explains it, more Web3 onramps are coming that will revolutionize our understanding of NFTs. The real challenge now is finding newer ways of democratizing access to NFTs and widening inclusivity particularly for those from emerging economies like Nigeria. With the passage of time along with technology’s exponential gap, more use may yet be found for NFTs that are currently undiscovered.

I’m betting on it!

If you liked this piece feel free to share it far and wide. Feedback and criticism are welcome too. You can also consider supporting me financially by making a donation:

BTC: bc1qjgdvntg0j742qrctx66g59sl647cselmluah9g

ETH: 0xEb5F306dAA34f9190E780b5A0eF58Dc300d17F9a

Kuda Bank: 2000947237

I loved your post.

Another great article 👏